At the Goldman Ruge Group, we work with a lot of local buyers and sellers and most want to know if we are in a housing bubble and when it will end? We have written about the current housing marketing numerous times this year on our blog but there is one important point, above all else, that we want to make sure everybody understands as it pertains to where the housing market is today and where we are heading.

According to a recent report by the National Association of Realtors which was prepared by the Rosen Consulting Group…

- Construction of new housing over the past two decades fell 5.5 million units short of historical growth levels. This was largely a hangover effect of the great recession and the last real estate boom and bust cycle that we never fully recovered from. Although the number is historically large, the effective shortage is actually around 6.8 million housing units when you factor in inventory that is aged, destroyed, and/or replaced.

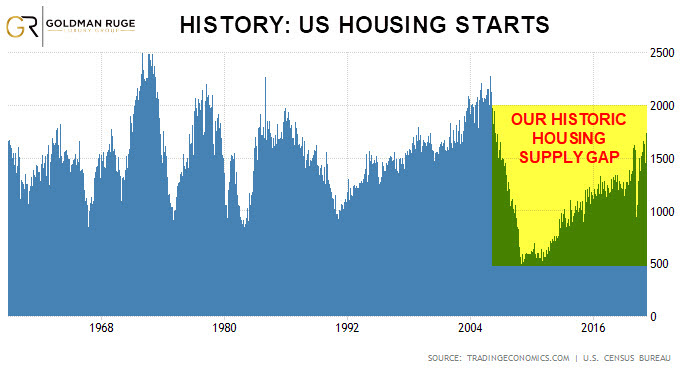

- Breaking this number down further, around 275K fewer homes per year were built between 2001-2020 compared to periods between 1968 and 2000. As you can see from the accompanying US House Starts chart, this historic dip (highlighted) could now require 2.1 million new units per year, a building level not seen since 2005, over a period of ten years to even close the current housing demand gap. To put this in perspective, total US housing starts for 2020 were only 1.38M.

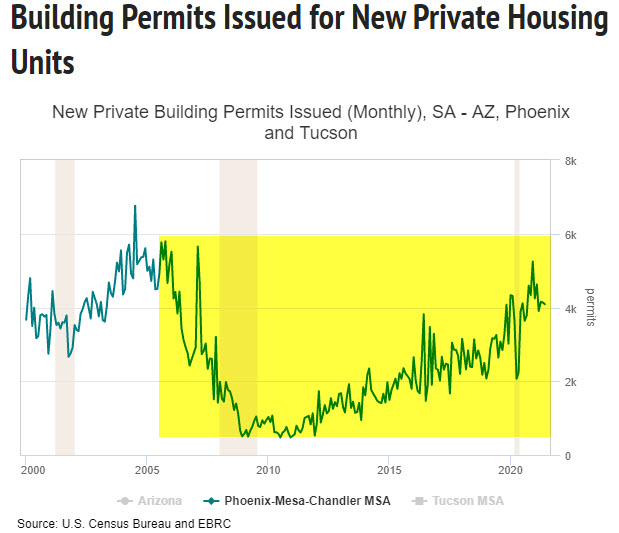

Closing this gap has been further stymied by current builder market conditions. Many of the builders we work with here in Arizona are telling us how long the building process is now taking when dealing with such factors as permitting delays, labor shortages, building materials and supply shortages, etc. So despite higher prices and demand, these supply chain restrictions continue to hold builders back in closing this gap in the short-term and as the numbers tell us, this would need to continue at an unprecedented rate over an unprecedented period of time to finally catch up.

There are also many other factors effecting the current real estate market including record low interest rates, inflation hedging, impacts of COVID, institutional buying, and overall migration of people to Arizona, etc. But many of these may be more temporary or transitory where growing long-term housing supply shortages are not. So, does this mean we are in a housing bubble as some now claim or is this something different?

According to Investopedia, there are 5 stages of a market bubble: Displacement, Boom, Euphoria, Profit Taking, and Panic. If we are in fact in a real estate bubble now, it is clear that we are likely at the “Euphoric” stage with record demand and prices. But following the bubble progressions that would also indicate that the next phase would be profit-taking followed by panic. Certainly, there are some people who are cashing out now but unlike stocks that can easily be bought and sold, most homeowners simply have nowhere else better to go if they sold.

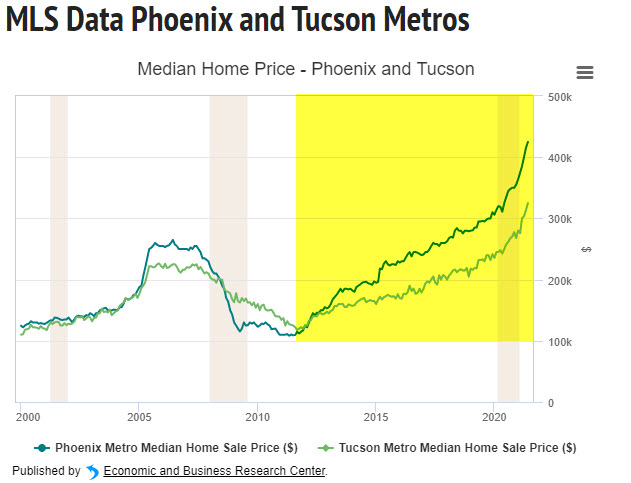

So, until we see heavy levels of profit taking leading to panic selling, it is hard to call the current housing market a bubble. Moreover, as the numbers alone now indicate, it could take a decade or longer just to get housing supply caught up to demand and how many housing bubbles have historically been stuck in a decade-long Euphoric bubble? And what if the market finally “cools off,” home prices stabilize, and fewer buyers bid on homes? Does that mean that profit-taking and panic will follow, or will the market simply be hitting a supply-demand equilibrium based on current market conditions?

In conclusion, if you are concerned about how best to “time the market”, just remember that historically in Arizona, we have seen price and inventory changes before – this is nothing new. But what we haven’t seen in recent history is a housing shortage of this magnitude both locally and nationally. Based on the historic new housing unit gap alone we are now facing, it could take us a decade or longer just to catch up to a more balanced housing market. Until then, despite all other factors, we expect our clients’ investments in their Arizona homes to continue to remain strong in the years to come.

HOW WE CAN HELP YOU…

The Goldman Ruge Luxury Group provides luxury property owners, buyers, and sellers in Arizona with the highest level of service and support when dealing with one of the largest personal financial decisions our clients will make in Arizona. Our clients depend on us as their trusted advisors for all aspects associated with their luxury properties both including and beyond the home buying and selling processes by helping them protect and maximizing the asset value of their luxury properties. We primarily focus on luxury property sales in the Paradise Valley, Arcadia, Scottsdale, and Phoenix areas.

LET US HELP YOU…

FIND OUT WHAT YOUR LUXURY HOME IS CURRENT WORTH

RECEIVE A FREE COPY OF OUR PRE-LISTING GUIDE

SELL YOUR HOUSE QUICKLY AND FOR TOP DOLLAR

FIND YOUR LUXURY DREAM HOME IN ARIZONA NOW