For well over a year now anybody outside of the “transient inflation” FED could see inflation coming – which historically leads to interest rates hikes to follow. The historic rate of interest rate increases was so dramatic starting in 2022 that many industries from banking to real estate became negatively impacted in a very short period. As a result, it was recently reported that the 30-year mortgage interest rates have now hit a 20 year high at over 7% and some think it could even go to 8% depending on Fed actions in the coming weeks.

We had been warning about effects this could have by creating a “frozen market” for real estate based largely on people not wanting to give up their now historic mortgage interest rate loans in order to move up or move out.

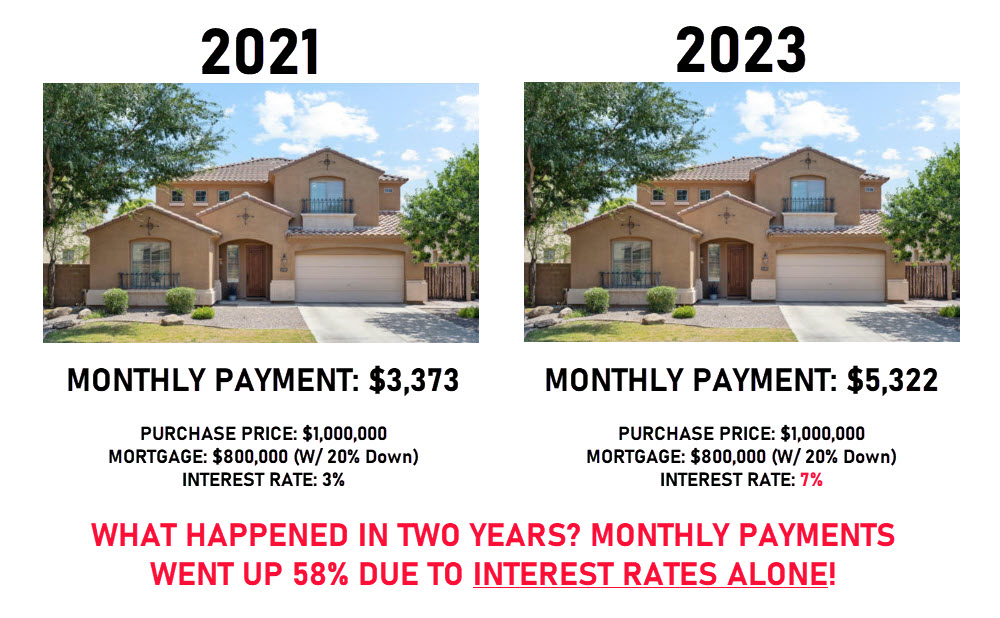

The easiest way to help illustrate this impact based on interest rates alone can be seen in the example below…

In the example above, we take an average home valued (for the sake of simplicity) at $1M. With 20% down, that leaves a mortgage of $800K. Now in August of 2021, interest rates on a 30-year mortgage were around 3% which means your mortgage payment alone on that home would have been around $3,373 per month. Not bad!

Now let’s fast forward two years and see what happens – all things being equal (except interest rates)…

That same home valued at that same price would now have a mortgage interest rate of around 7% resulting in a mortgage payment of $5,322 – which is a 58% HIGHER monthly payment for the same home two years ago! And this doesn’t even factor in house price appreciation, increased property taxes, etc.

As we have previously discussed, there are two general types of home buyers: the move-up buyers and the move-in buyers. The move-up buyers will typically sell and then buy a replacement home in the same market while the move-in people are either selling and relocating from another market or buying a second (additional) home in a new market – which is very common in places like Paradise Valley. Let’s look at each relative to the example above to see how interest rates changes impact their decision making in today’s market.

MOVE-UP BUYERS

Let’s say, in the example above, that the buyer of the home in 2021 decides they now want to sell their home and are located in zip code 85253. Based on average price square footage sold, their existing home bought in 2021 would have appreciated around 50% over the past two years, putting it at a new market value of around $1.5M. Not bad right? Well, where are they going to go when they sell and at what cost? Let’s say they want to sell and take the proceeds to buy a new home valued at $1.5M (at the same relative value of their existing home). After selling and moving costs, they would now have around $550K to put down leaving them with a new mortgage of $950K and a new monthly mortgage payments of around $6,320 per month – ALMOST DOUBLE their previous mortgage payments for a home of the same relative value in 2021! And as recently reported, Americans are now spending around 40% of their average household income on housing costs – far in excess of the traditional 28% rule which means even if they wanted to increase their monthly payments, many can’t afford to.

So, what do you suppose their primary concern is with this potential move? Well, if they bought in the same market then their new home would be virtually the same because what they gained in appreciation on their previous home would be equal to the market price gain on their new home leaving them with virtually the same home at twice the monthly cost. Why bother, right? Why not just stay put and “wait it out” until interest rates and home prices come down…which is where most “move-up” buyers are today and why inventory of existing homes remains so low.

MOVE-IN BUYERS

Let’s say somebody wants to buy a second home in Arizona but they are trying to “time” the market so they can get both a lower interest rate and a lower price. We have met many of these types of people over the past two years and so far, all have guessed wrong. Instead of things getting better, low inventories (resulting from the problems listed above) have kept prices high while interest rates continue to climb.

Using our previous example, let’s say a move-in buyer finally found a home now worth $1M they want to buy in 85253. Their payments would now include $5,322 per month on a home that likely increased in value by 50% over the past two years prior to them buying it. What do you think their primary concerns are? Even if they pay with cash, interest rates are less important than a potential price correction. Why? Because they can always refinance down the road if rates drop low enough but they cannot change the purchase price basis of the home they want to buy now – the market does that for them. This means more move-in buyers are looking for a “good deal” that they feel could help protect them against any potential price correction in the near future. This is also why working with an experienced local real estate agent with intimate knowledge of inventory (both on and off market) becomes so critical in market likes these.

So, what does all this mean for today’s real estate market? Even though both buyers have different primary concerns, they are both connected by one thing: interest rates. If the move-up people won’t sell their homes to buy up, then the inventory for move-in buyers remains low thereby keeping prices high. And because new home builders cannot keep pace with this demand, only when interest rates decline, opening new sales inventory and increased velocity for the move-up people will we likely see any real correction in home prices – which the move-in people are most afraid of.

Welcome to our historically frozen real estate market!

HOW WE CAN HELP YOU…

The Goldman Ruge Luxury Group provides luxury property owners, buyers, and sellers in Arizona with the highest level of service and support when dealing with one of the largest personal financial decisions our clients will make in Arizona. Our clients depend on us as their trusted advisors for all aspects associated with their luxury properties both including and beyond the home buying and selling processes by helping them protect and maximizing the asset value of their luxury properties. We primarily focus on luxury property sales in the Paradise Valley, Arcadia, Scottsdale, and Phoenix areas.

LET US HELP YOU…

SEARCH FOR YOUR NEXT LUXURY DREAM HOME IN ARIZONA NOW

WHY YOU SHOULD CONSIDER LISTING YOUR HOME WITH US

HOW TO SELL YOUR ARIZONA LUXURY HOME FOR TOP DOLLAR

HOW TO FIND THE BEST LUXURY HOME FOR YOUR NEEDS IN ARIZONA

SIGN UP FOR OUR MONTHLY NEWSLETTER TO RECEIVE EXCLUSIVE UPDATES ON ARIZONA’S LUXURY HOME MARKET