If you own a home or property in Maricopa County, you likely received your 2023 property valuation notice in the mail over the past week. And like many people, you might be initially surprised to see that your Full Cash Value (FCV) number increase significantly over the past year. With the recent boom in real estate prices over the past few years, housing prices in Maricopa County have been appreciating at record rates and along with it, many people may now wonder how all of this will affect their property taxes as a result.

Tax notices can be difficult for the average homeowner to decipher – these are, after all, Government documents. So, to help make sense of what you are reading, it is important to start by understanding a couple of important points.

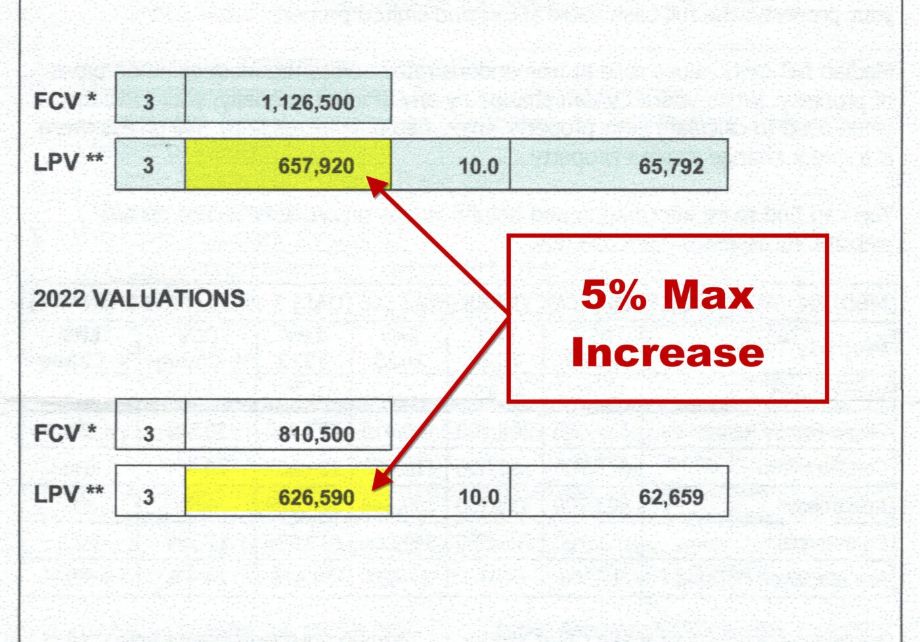

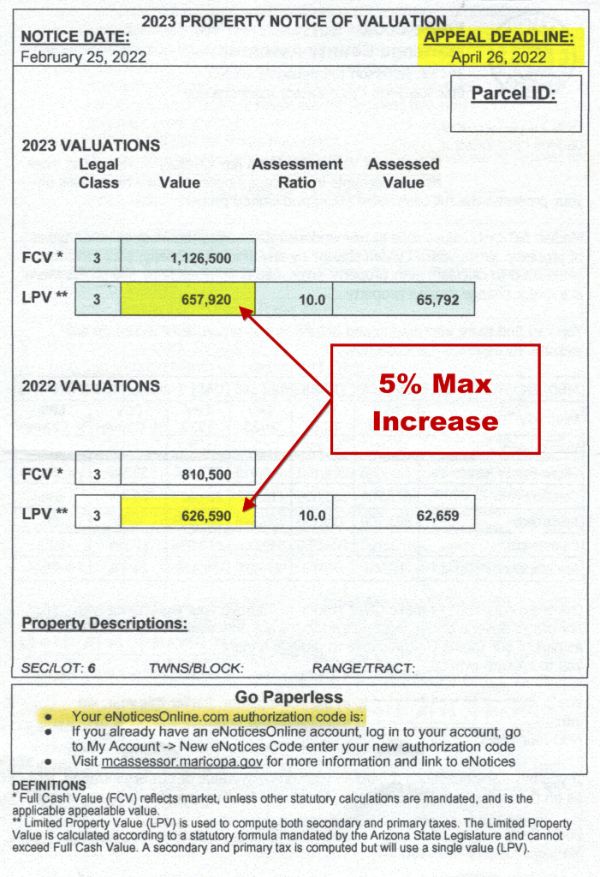

First, “FCV” stands for Full Cash Value and “LPV,” which is the number used to calculate your property taxes, stands for “Limited Property Value” (see adjacent example).

Second, due to the passage of prop 117 back in 2012, the annual increase in your taxable value cannot exceed 5% or your FCV – whichever is lower.That is, unless you have made a “major change” to your property which can trigger a “Rule B” valuation which then allows the assessor the recalculate your new LPV based on a real estate classification ratio of your new FCV for your property. For Single family homes in Maricopa County, this ratio for 2023 is 55%.

For example, let’s say you built a new casita that triggered a “Rule B” on your property and the assessor then increases the Full Cash Value (FCV) of your property from $2M to $3M. In this example, you can expect your new taxes to be based on a LPV of around $1.65M ($3M x 55%). In short, most people don’t want to trigger a “Rule B” valuation if they can avoid it.

Finally, there are two ways to appeal your assessment. You can either file an administrative appeal with the county accessors office within 60 days of your notice, or you can file a judicial appeal with the Arizona tax court which you have until December 15th to file. The only number you can appeal is your Full Cash Value (FCV), and as we previously discussed, this becomes important when you trigger a “Rule B” because your new tax is based on a ratio of your new FCV – which means the lower you can potentially get your new FCV the better. Any appeal beyond a “Rule B” triggered appeal may be a waste of time – especially if there is little/no chance of getting your FCV lower than your LPV.

BETTER UNDERSTANDING “RULE B” VALUATION

To help better understand all of this, we spoke with James “Jim” Nearhood of the Nearhood Law Offices based in Scottsdale. Jim is considered by many to be a preeminent authority on handling real estate tax matters in Arizona, and the fact that nearly all of his tax appeals cases are settled before they ever get to trial is a good indication that he knows this area of tax law well.

According to Jim, a “Rule B” is commonly triggered based on 4 major events:

- When land it split off

- When land is consolidated into one parcel

- When a property is demolished, torn down, or burned down

- When a new “major improvement” to the property takes place such as the building of a new guest house, level, expansion, etc.

For many of our clients who live in the greater Paradise Valley and Arcadia areas, there has been a lot of improvements and renovations that have taken place to their houses over the past few years alone. And if you own an older home, the last thing many people want to do is to trigger a “Rule B” on their property – thereby potentially raising their property taxes…and in some case significantly.

To help avoid this, Jim indicated that Arizona law defines a “major improvement” as any improvement made in excess of 10% of the property’s FCV – which could then trigger a Rule B on that property. For example, if your property has a current FCV of $3M and you want to build a new casita on your property, you will want to keep the new building cost under $300K (or 10% of $3M) if you want to help avoid triggering a “Rule B” on your property.

WHEN YOU SHOULD CONSIDER FILING AN APPEAL

When asking Jim why somebody might consider an appeal, his answer was simple; “Anytime they get a Rule B.” Why? Because you want to make sure your new assessment is accurate and there were no mistakes made in the process. And if you can lower the FCV as a result of the appeal, the impacts on the LPV could be significant, because that is where your new property taxes are calculated from. He also added that it is important that any filing happened during the year the “Rule B” is triggered, and in some cases, this could be more than a year after an improvement is made – so always keep an eye on the annual change in your LPV each year.

HOW DO YOU KNOW IF A “RULE B” CHANGE WAS APPLIED ON YOUR PROPERTY?

Don’t expect the county assessor to provide a “congratulations, you received a Rule B adjustment” letter along with your tax notice – Governments don’t work that way. So, what if you made improvements to your property over the past few years and want to know if that potentially triggered a “Rule B” on your valuation or not? According to Jim, the easiest way to figure this out is to simply look at your previous year’s LPV compared to the most recent LPV, and if the increase was greater than 5%, then you likely triggered a “Rule B.” And if you have seen a significant increase in your LPV from the previous year, you might want to consider an appeal – especially if you think it was inaccurate or unfair.

HOW TO APPEAL YOUR PROPERTY TAXES

If you believe that your property taxes are incorrect, you have the right to appeal by filing an administrative petition with the Assessor’s Office within 60 days of the notice date, or no later than the appeal deadline – which should be listed at the top of your valuation notice just above your updated valuation numbers for 2023 (see above example). If you have a more complicated tax matter dealing with reclassifications or “Rule B” changes, you might want to consider the judicial route instead. By contacting an experienced attorney like Jim Nearhood (https://www.nearhoodlaw.com/), you can potentially save both time and money by relying on decades worth of experience and advice in dealing with this matter instead.

FINAL THOUGHTS & ADVICE

One of the many great advantages of living in a state like Arizona is the relatively low property taxes we pay here- we hear this all the time from people moving here from other high tax states. But just because your new property taxes here may be relatively low, there can still be large variations in the taxes paid from house to house – even in places like Paradise Valley and Arcadia. So here are some things to keep in mind each year when you receive your notice of property valuation:

- If you plan on making “major changes” to your property and don’t want to potentially trigger a reassessment that could raise your property taxes by more than 5%, try to keep those changes under 10% of your current year’s FCV.

- Always check the annual increases in your LPV, and if they are greater than 5%, try to determine why you may have triggered a “Rule B” increase. And if you need expert advice, call an expert like Jim Nearhood to help advise you on your options.

ADDITIONAL RESOURCES

Property Tax Educational Videos:

Maricopa County Appeals link: https://www.mcassessor.maricopa.gov/page/appeals/

6 Legal Property Classifications (Assessment Ratio):

- Commercial (18%)

- Vacant Land (15%)

- Primary Residence (10%)

- Residential Rentals (10%)

- Non-Primary Residence (10%)

- Historic Residential (5%)

Rule B Tax Ratios 2023 In Maricopa County:

- Primary Residence, Single Family Home: 55%

- Vacant Land: 47%

- Rental Property: 57%

Dustin W. Ruge – Author

HOW WE CAN HELP YOU…

The Goldman Ruge Luxury Group provides luxury property owners, buyers, and sellers in Arizona with the highest level of service and support when dealing with one of the largest personal financial decisions our clients will make in Arizona. Our clients depend on us as their trusted advisors for all aspects associated with their luxury properties both including and beyond the home buying and selling processes by helping them protect and maximizing the asset value of their luxury properties. We primarily focus on luxury property sales in the Paradise Valley, Arcadia, Scottsdale, and Phoenix areas.

LET US HELP YOU…

FIND OUT WHAT YOUR LUXURY HOME IS CURRENT WORTH

RECEIVE A FREE COPY OF OUR PRE-LISTING GUIDE

SELL YOUR HOUSE QUICKLY AND FOR TOP DOLLAR

FIND YOUR LUXURY DREAM HOME IN ARIZONA NOW