Over the past year many people have watched the Fed dramatically raise interest rates, the economy sputter, and then ask the same question: “Why haven’t home prices crashed yet in Arizona?” Some ask this question trying to “time the bottom” by trying to determine when to buy back in while many others simply can’t understand why this real estate market has defied so many naysayers who predicted a housing marketing crash over a year ago…that still hasn’t happened.

So, what is happening and why has the luxury real estate market in Arizona stayed so resilient? As with many questions, the answer can be complicated. So to help keep it simple, we will help explain why this is happening in 6 major reasons…

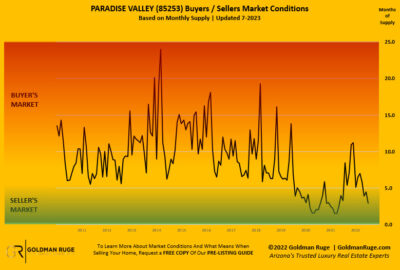

- Paradise Valley, ground zero for luxury real estate in Arizona, has a limited supply of homes, homes sites to build on, and an even smaller supply of newer homes which most luxury buyers want to buy at this price range. There are only around 5,800 total housing units in Paradise Valley and of those, only 20% were built AFTER the year 2000…which means most of the 80% of the remaining homes in PV still need to be updated and/or replaced in order for new buyers to want to buy and live in them. This helps to explain why new builds are selling for over 100%+ MORE per square foot than many of their neighbor’s aging homes built on similar dirt. Most luxury buyers today don’t want to live through a remodel and due to a lack of new builds, are still paying record prices for new builds as a result.

- Arizona is still a high-demand state for people looking for better options. Arizona’s new 5% flat tax, the lowest tax rate in the nation (not withstanding zero income tax alternatives) along with our low property tax rates, currently rated as the 6th lowest in the nation, creates a compelling tax-advantage over competing states – including zero income tax states like Texas and Florida.

- Our historical housing inventory issue dates back over a decade. As we previously reported, the US is currently around 6.8 million housing units short of demand and at current rates of production, could take a decade + just to catch up…assuming it does. As a result, supply should continue to lag demand for the next decade plus! Adding further insult to injury, Institutional Investors now own around one fourth of all single family homes in the US. This means that as long as they continue to own these homes as rentals/investments, the effective inventory of all homes that could be purchased is even lower than what total housing inventory numbers may reflect.

- Historically high interest rates have now frozen the majority of the real estate market. Most homeowners are now “locked-in” at historically low interest rates and as a result, don’t want to sell and in doing so, give up both their home AND their low mortgage rates. So how pervasive is this? Consider that over 90% of homeowners are now locked in at interest rates below 6%, 82% below 5%, 62% below 4%, and 24% below 3% . Most homes are sold with mortgages that have a due-on-sale clause meaning only a few types of mortgages (USDA, FHA, and VA loans) are assumable – most of which would not be found in the luxury home markets. Studies have also shown that the majority of sellers (56%) plan to wait until interest rates decline which means the “move-up” sellers/buyers are now largely frozen leaving only the “move-in” buyers as the only active market until interest rates markedly decline. In short, the only largely movable supply is new supply. For example, historical homes sales of “new homes” averaged around 13%. Today, new home sales are around 30% – nearly double their historical averages.

- Baby boomers are now retiring in mass to more desirable states like Arizona. Most baby boomers will be age 65+ over the next 7 years and currently and have a medium net worth of around $1.2M – controlling around 53% of America’s wealth. As they continue to look for retirement locations, states like Arizona, who now has the lowest state income tax rate, very low property tax rates, lots of sun, and don’t have hurricanes and high homeowners / flood insurance rates (compared to Florida) are looking more and more attractive to the “move-in” crowd each year. That means even more demand from a lot people with a lot of money to buy and move in.

- Inflation is now at highs we have not seen for many decades and historically homeownership has been a great hedge against inflation. Even during the poor economy of the 1970’s, average home prices doubled with an average annual gain of nearly 10%. So how long could this last? It’s hard to tell. But as we have written about for over a year now, it was not hard to see that inflation was coming and what that has historically meant for the housing market.

So when will prices correct or even crash? As our previous market reports show, prices already seem to be slightly correcting and/or plateauing in PV and Arcadia but for how long and how deep is the real question. It was pretty clear to us when a 1.25 acre piece of dirt in PV recently sold for a record $7M, we might have reached the peak in the market. But unlike previous markets, the aforementioned 6 stated reasons above should continue to put demand pressure on our local luxury real estate market possibly resulting in the “soft landing” many of the Fed have been shooting for. Time will tell…

HOW WE CAN HELP YOU…

The Goldman Ruge Luxury Group provides luxury property owners, buyers, and sellers in Arizona with the highest level of service and support when dealing with one of the largest personal financial decisions our clients will make in Arizona. Our clients depend on us as their trusted advisors for all aspects associated with their luxury properties both including and beyond the home buying and selling processes by helping them protect and maximizing the asset value of their luxury properties. We primarily focus on luxury property sales in the Paradise Valley, Arcadia, Scottsdale, and Phoenix areas.

LET US HELP YOU…

SEARCH FOR YOUR NEXT LUXURY DREAM HOME IN ARIZONA NOW

WHY YOU SHOULD CONSIDER LISTING YOUR HOME WITH US

HOW TO SELL YOUR ARIZONA LUXURY HOME FOR TOP DOLLAR

HOW TO FIND THE BEST LUXURY HOME FOR YOUR NEEDS IN ARIZONA

SIGN UP FOR OUR MONTHLY NEWSLETTER TO RECEIVE EXCLUSIVE UPDATES ON ARIZONA’S LUXURY HOME MARKET